Python can be used for various tasks. One of these is Monte Carlo simulation for future stock analysis. In the video below this is exactly what is happening. 🙂

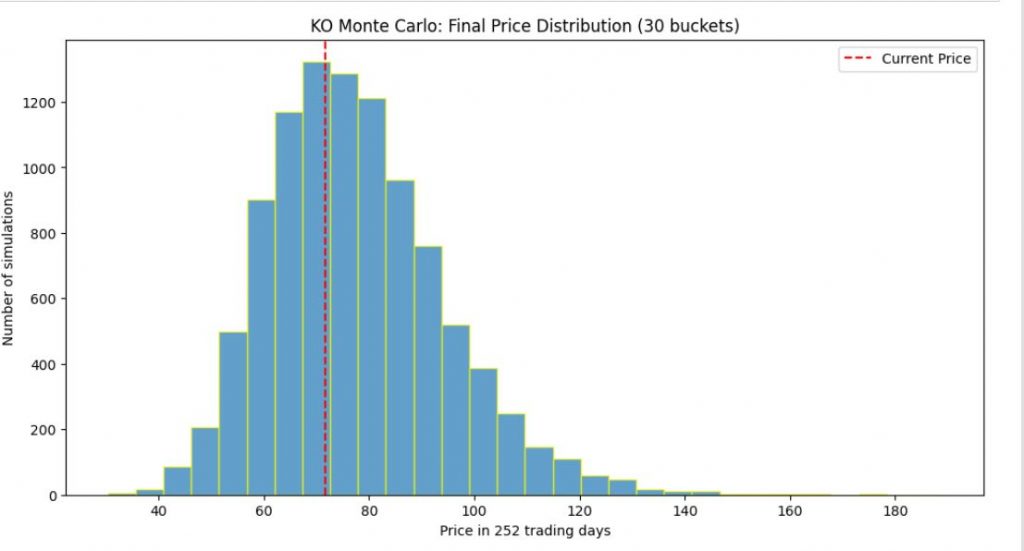

10K simulations in 30 buckets for KO look like that.

Instead of explaining the video and its code (available also in GitHub), I will concentrate on why it is better to use log returns than simple returns in stock analysis. Which is actually part of the video as well. Below are the 3 main reasons:

1. Time-Additivity

Log returns sum over time, making multi-period calculations effortless. A 10% gain followed by a 10% loss doesn’t cancel out with simple returns—but it nearly does with logs.

2. Symmetry Matters

A +10% and -10% return aren’t true inverses in simple terms. Logs fix this, ensuring consistent math for gains and losses.

3. Better for Modeling

Log returns follow a near-normal distribution, crucial for statistical models like Monte Carlo simulations.

When to Use Simple Returns?

Code Highlights